ev tax credit 2022 reddit

That is the 7500 is halved etc. With no tax credit on the 2022 its a lot more of a gamble than previously.

The new EV tax credit allows for a transfer of credit to a car dealer Inflation Reduction Act of 2022 pp.

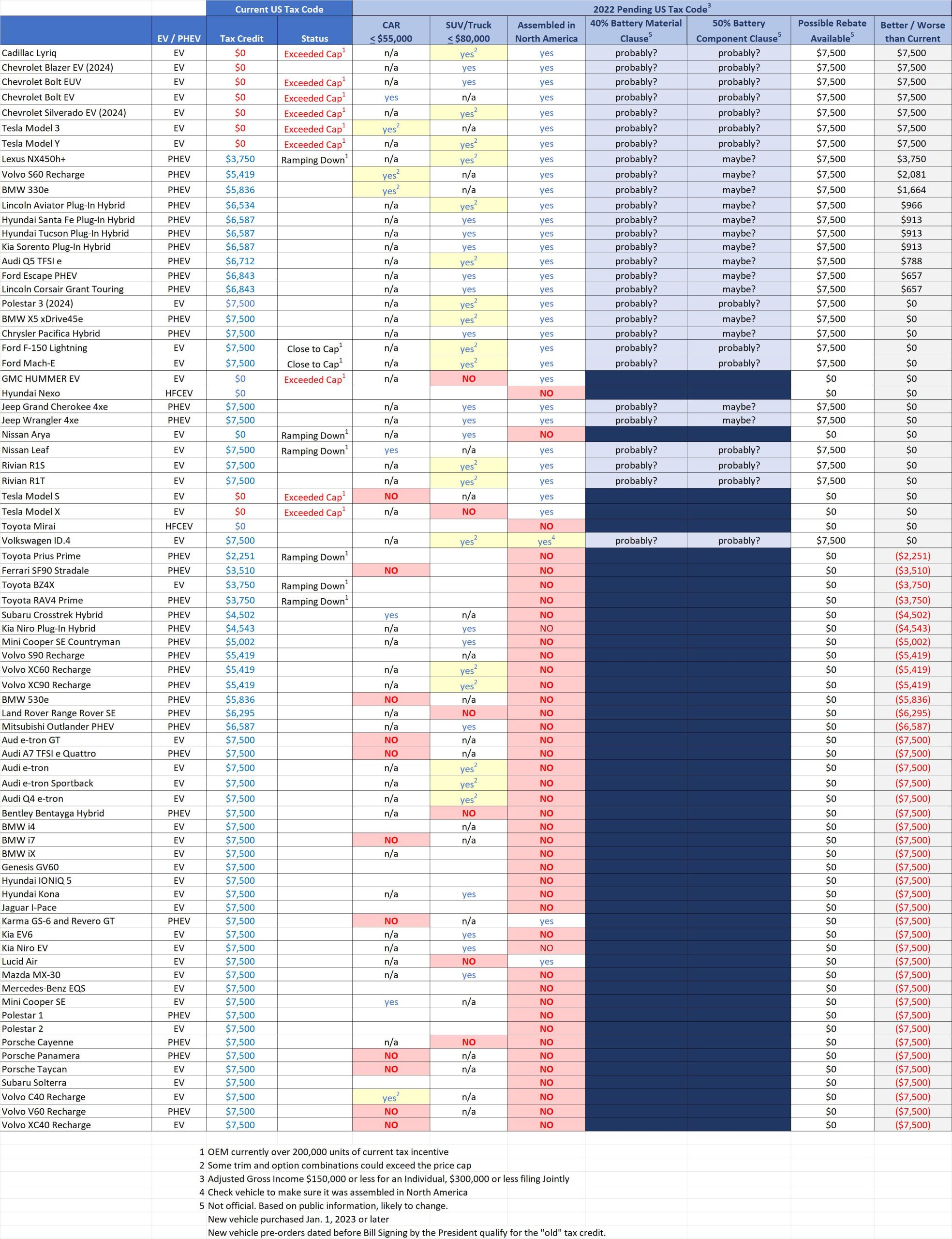

. Toyota runs out of credits. The federal EV tax credit will change if the Inflation Reduction Act is signed into law. While many of them wont kick in until the end of 2022 or even years.

Now that the US Senate has an agreement on the reform of the federal tax credit for electric vehicles it looks like it might finally happen after roughly two years of work. Federal EV tax credit May 2022. The original tax credits allocated based on the number of EVs sold by.

That cap is lifted on January 1 2023 so cars tagged as manufacturer sales cap met will not qualify for the electric car tax credit until next year. DETROIT A tax credit of up to 7500 could be used to defray the cost of an electric vehicle under the Inflation Reduction Act moving toward final approval. Jan 2022 EV tax credit.

How are we assured of getting the full 7500 credit. While the bill improves the EV tax credit in many ways including making it available at the point of sale and removing the 200k credit cap per manufacturer and. BUT it doesnt apply until 2023.

BUT it doesnt apply until 2023. For the federal credit a manufacturer will have its credit value halved once 200000 electric vehicles. Ad Driving an electric car now comes with added benefits for driving a clean car.

For instance if youre single and your line 15 taxable income shows 50000 then your tax liability would be 6754 before any credits. In 2022 taxpayers may be eligible for a federal tax credit of up to 7500 for electric vehicles. Its possible that it could be part of a compromise but not enough Democrats supported it when they controlled the House Senate and Governor so cant see how theyll make this a top priority when they could have done it much more easily last year.

EV tax credit - bought in 2022. Aug 12th 2022 at 128PM. Its possible just very unlikely with Republicans controlling the House and Governors mansion.

As a rough rule of thumb figure 500 for the. When you prepare your 2021 tax return there is a form to claim the credit. According to Automotive News the Biden Administration said on Tuesday that around 20 EV models will remain eligible for the 7500 EV credit through the end of 2022.

Discuss evolving technology new entrants charging infrastructure government policy and the ins and outs of EV ownership right here. President Joe Biden signed the Inflation Reduction Act on Tuesday including a crucial tax credit of 7500 on electric vehicle EV purchases. Federal EV tax credit May 2022.

The Inflation Reduction Act also extended the 7500 tax credit we all know and love but added a number of stipulations. So searched Reddit and there a number of posts about the recently passed bill. This is the Reddit community for EV owners and enthusiasts.

Bought the car Prime SE October 2022. We file for 2022 So question. Here are some of the tax incentives you can expect if you own an EV car.

Posted by 5 months ago. The Inflation Reduction Act Keeps EV Tax Credits at 7500 Max. This is the Reddit community for EV owners and enthusiasts.

What I cant find is any tax credit if bought in 2022. The credit is non-refundable which means you will only get a credit against your tax liability up to your tax liability amount. In other words you still pay the 7500 now at the time of purchase but will receive the tax credit next year.

The House is expected to pass it on Friday and then it will be sent to President Biden to be signed into law. The main portion of the bill our readers will be interested in is the 7500 electric vehicle tax credit which is renewed starting in January 2023 and will last a decade until the end of 2032. I would not count on it being funded.

Rivian Fisker and. So searched Reddit and there a number of posts about the recently passed bill. In other words I would buy the vehicle today during the transition period between 816-12312022.

The Inflation Reduction Act includes a new tax credit of up to 4000 on used electric vehicles. It has already been passed by the Senate. The Inflation Reduction Act of 2022 which as mentioned is expected to be signed soon by President Biden contains tax breaks for.

My Tax Year 2022 income for which a return will be filed by April 2023 EXCEEDS the new income cap guidelines of 150000 for single filers 225000 for head of household or 300000 for joint filers. August 11 2022. Rivian Fisker and.

You may notice something surprisingtheres no way to get an EV tax credit in 2022 for a Tesla or GM EV. Electric vehicle enthusiasts have been arguing to extend the United States Federal tax credits for purchasing battery-electric and plug-in hybrid vehicles. This means that the car dealer can take.

If you buy a car now in August 2022 you cannot claim the 7500 credit until you file your taxes in 2023. While the bill improves the EV tax credit in many ways including making it available at the point of sale and removing the 200k credit cap per. August 17 2022 by Peter McGuthrie.

Here S Every Electric Vehicle That Qualifies For The Current And Upcoming Us Federal Tax Credit Electrek

Here S Every Electric Vehicle That Qualifies For The Current And Upcoming Us Federal Tax Credit Electrek

Here S Every Electric Vehicle That Qualifies For The Current And Upcoming Us Federal Tax Credit Electrek

Build Back Better And Ev Tax Credits R Electricvehicles

Ev Tax Credit Details In The Inflation Reduction Act R Rivian

Here S Every Electric Vehicle That Qualifies For The Current And Upcoming Us Federal Tax Credit Electrek

Volvo S Losing Ev Federal Tax Credit From Inflation Reduction Act R Volvo

Here S Every Electric Vehicle That Qualifies For The Current And Upcoming Us Federal Tax Credit Electrek

Here S Every Electric Vehicle That Qualifies For The Current And Upcoming Us Federal Tax Credit Electrek

Ev Tax Credit Details In The Inflation Reduction Act R Rivian

Here S Every Electric Vehicle That Qualifies For The Current And Upcoming Us Federal Tax Credit Electrek

Here S Every Electric Vehicle That Qualifies For The Current And Upcoming Us Federal Tax Credit Electrek

Here S Every Electric Vehicle That Qualifies For The Current And Upcoming Us Federal Tax Credit Electrek

See Refreshed Tesla Model S Drive Away From Supercharger

Looks Like Rivian Is Allowing Reservation Holders To Sign A Binding Contract To Be Eligible For The 7500 Federal Tax Credit Before The New Inflation Reduction Bill Passes R Rivian

Will Your Ev Qualify For Federal Incentives With The Climate Bill